Digitizing Legacy Systems with Secure Generative AI

WHITEPAPER: Digitizing Legacy Systems with Secure Generative AI

In 2023, consumers expect the same functionality from their financial institutions as they do from personal technology. Enterprise financial leaders are finding that providing consumers with such fluid experiences means either digitizing their legacy systems and properly cultivating data from across the enterprise, or risk losing their customer base to competitors who will.

De-risking Generative AI

Delivering on the customer service and compliance promises of AI without complaints or compromises.

In 2023, consumers expect the same functionality from their financial institutions as they do from personal technology. Enterprise financial leaders are finding that providing consumers with such fluid experiences means either digitizing their legacy systems and properly cultivating data from across the enterprise, or risk losing their customer base to competitors who will.

“We believe that generative AI is filling that hole, it’s now taking the information that can be extracted, and it’s making use of it by putting it into the backend systems that need it.”

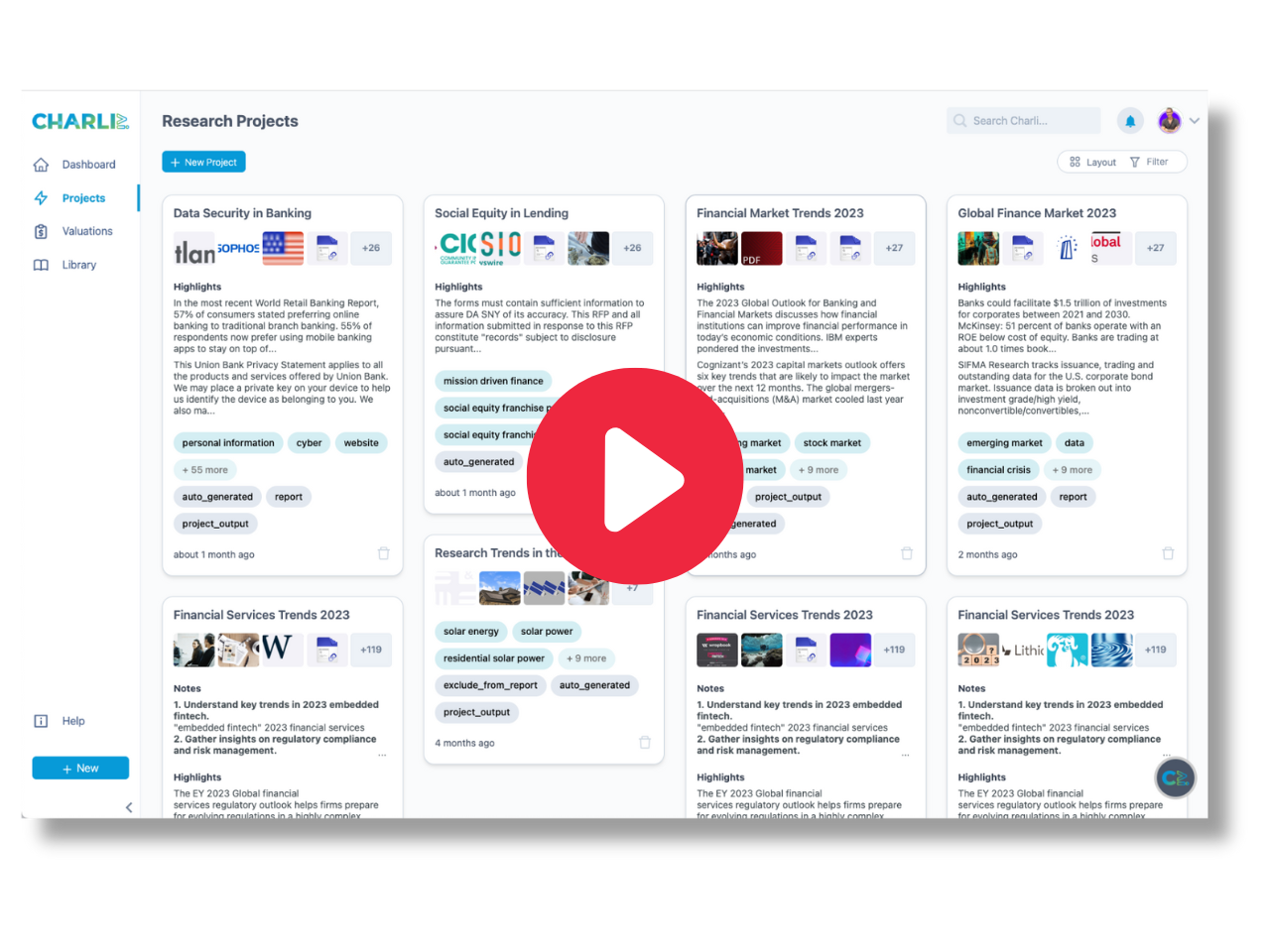

Kevin Collins, CEO & Founder @ Charli AI