SOLUTION

KYC / AML

KYC and AML are crucial for the enterprise – these procedures maintain the trust and integrity of financial institutions and ensure compliance with regulatory requirements. Ensuring compliance, protecting against potential threats, and promoting the well-being of financial institutions can be done right within Charli AI.

Know Your Customer

Track relevant data and information at lightning speed

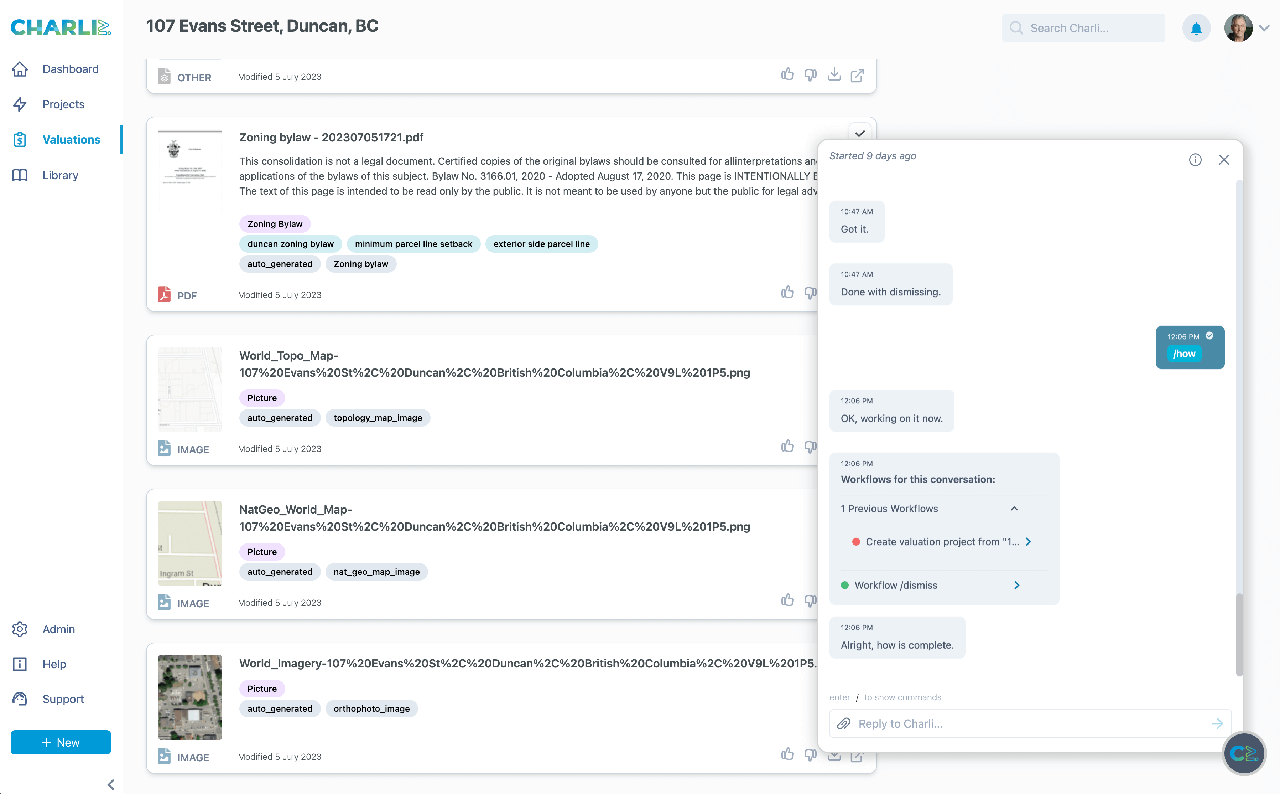

Our Secure-by-Design AI can make tracking relevant information easier than it’s ever been. Track transactions, public and private filings on companies or individuals, create alert systems around necessary changes in information, and allow your team to process documentation faster so they can get to insight and make agile business decisions.

Reduce errors while cutting costs

Since there is no standardization to KYC at this time, Charli AI is able to quickly pull relevant information while fact-checking and summarizing. Using our Secure-by-Design AI for this process, organizations can quickly and efficiently cut overhead costs, unexpected delays, and a variety of clerical errors associated with any kind of manual identity verification.

Create scalable and secure processes

KYC & AML processes are historically hard to scale – relying on busy humans to facilitate the process can create bottlenecks. More and more consumers are handing over information and the collection of that PII can become slow and cumbersome until now. Manual KYC & AML and disparate data storage can cause catastrophe. Charli AI is stable, secure, and scalable and loosens the bottlenecks so your team can get to insight at lightning speed.